Investment Activity

Investment Program Parameters

Actual disbursement of capital investments for the reporting period amounted to RUR 15,813 mln.

Dynamics of basic indicators of the investment program in 2009-2010

| JSC "Lenenergo" | Disbursement | Commissioning of fixed assets | Funding | Commissioning of capacities | Capacity gain | ||

|---|---|---|---|---|---|---|---|

| RUR mln,

net of VAT | RUR mln | RUR mln,including VAT | MVA | km | MVA | km | |

| 2009 | 10 334 | 10 062 | 12 321 | 832 | 669 | 619 | 430 |

| 2010 | 15 813 | 13 750 | 16 428 | 932 | 1508 | 863 | 1 091 |

| Growth rate | 153% | 137% | 133% | 112% | 225% | 139% | 254% |

In comparison with 2009, the volume of capital investments in 2010 increased by RUR 5,479 mln, with growth amounting to 53%.

The increase in parameters of the investment program of 2010 in relation to 2009 is associated:

- with implementation of the program of connection of objects of JSC "Gazprom Invest West" by RUR 1,288 mln;

- with the increase in works on technological connection of subscribers to distribution networks of 0.4-10 kV by RUR 1,006 mln;

- with the increase in volumes under property contracts on technological connection by RUR 1,916 mln;

- with the redemption of shares of JSC "Kurortenergo" and "Tsarskoselskaya Power Company" by RUR 890 mln;

- withdrawal of equipment from leasing by RUR 376,5 mln.

The investment program provides the growth of commissioning of fixed assets both in money and physical terms under an increase in disbursement of capital investments.

The volume of commissioning of fixed assets for the whole Company constituted RUR 13,750 mln, 932 MVA of transformer capacity and 1,508 km of transmission lines were commissioned.

Parameters of the investment program in St. Petersburg and the Leningrad Region in 2010

RUR mln

| Indicator | St. Petersburg | Leningrad region | ||||

|---|---|---|---|---|---|---|

| 2009

| 2010

| Growth rate | 2009

| 2010

| Growth rate | |

| Disbursement, RUR mln, net of VAT | 7 654 | 12 574 | 164% | 2 681 | 3 239 | 121% |

| Commissioning of fixed assets, RUR mln | 7 206 | 11 328 | 157% | 2 856 | 2 421 | -115% |

| Funding, RUR mln, including VAT | 8 670 | 12 704 | 147% | 3 651 | 3 723 | 102% |

| Commissioning of capacities, MVA | 495 | 704 | 142% | 337 | 228 | -132% |

| Commissioning of capacities, km | 316 | 995 | 315% | 353 | 512 | 145% |

| Capacity gain, MVA | 336 | 647 | 193% | 283 | 215 | -124% |

| Capacity gain, km | 253 | 912 | 360% | 176 | 180 | 102% |

The increase in parameters of commissioning of fixed assets in 2010 across St. Petersburg relative to 2009 is associated with:

- increase in volumes of work on building and reconstruction of 0.4-10 kV distribution networks on connection of consumers and statement on the balance of the works performed till 2010 (the fact of 2009 constituted RUR 2,104 mln, 262 km, gain of 222 km, the fact of 2010 constituted RUR 3,216 mln, 378 km, gain of 349 km).

- • statement on the balance of objects under property contracts. The sum of excess from 2009 constitutes RUR 2,275 mln, which in physical terms corresponds to 543 km, and 344 MVA.

The increase in disbursement of capital investments on the objects of the Leningrad Region is associated with the implementation of the program of connection of objects of JSC "Gazprom Invest West" by RUR 1,288 mln. The decrease in commissioning of fixed assets in 2010 is associated with building and reconstruction of objects of JSC "Gazprom Invest West", the commissioning of which is planned for 2011, and the delay in registration of title documents on the land plot of the "Kudrovo" substation, which has not allowed to enter into fixed assets the sum of RUR 131 mln on the substation put in operation.

Sources of funding of the investment program

Key sources of funding of capital investments of the Investment program of JSC "Lenenergo" in 2010 were as follows: depreciation, charges for technological connection, and borrowed funds (credits).

RUR mln, net of VAT

| Sources of investments, total | 15 813 |

|---|---|

| Own sources of funding | |

| Depreciation of the reporting year | 2 564 |

| Outstanding depreciation of past years | 92 |

| Undistributed profit of past years | 376,6 |

| Profit of the current year to be used in the investment program, including: | |

| Other own sources (property settlements, lost incomes) | 5 824 |

| External sources of funding | |

| Borrowed funds (loan, interest-bearing) | 3,371 |

| Payment for network connection - advances | 3,585 |

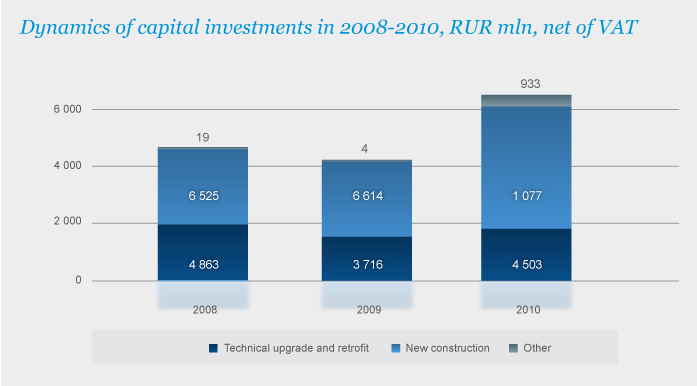

Structure of the investment program on directions of capital investments

RUR mln

| JSC "Lenenergo" | 2008 | 2009 | 2010 | 2010/2009, % |

|---|---|---|---|---|

| Total | 11 409 | 10 334 | 15 813 | 153% |

| Technical upgrade and retrofit | 4 863 | 3 716 | 4 503 | 121% |

| New construction | 6 525 | 6 614 | 10 377 | 157% |

| Other | 19 | 4 | 933 | 223 times

|

The analysis of structure of the investment program shows an increase in capital investments directed to both new construction and reconstruction of existing objects of power network economy of the Company. Considerable excess on new construction is associated with the increase in volumes under property contracts on technological connection.

The increase in other capital investments is associated with acquisition of shares of JSC "Kurortenergo" and "Tsarskoselskaya Power Company".

Within the framework of implementation of the investment program, the following tasks were solved:

- Maintenance in operational readiness of the equipment necessary for reliable, uninterrupted and qualitative power supply to consumers;

- Carrying out of actions for a decrease in production costs, including at the expense of an increase of overall performance of the equipment, development of systems of accounting of consumed energy supply;

- Modernization of fixed assets;

- Ensuring safety work of equipment and personnel;

- Provision of capacity of electric networks for steady functioning of the electric power industry and provision of connection of consumers;

- Increase of anti-diversionary and anti-terrorist security of power objects;

- Development of communication systems, telemechanics and data transmission for the purpose of an increase of controllability of networks and a decrease in the time of reaction to emergency situations;

- Carrying out of the events directed on innovative development of industry.

Endorsement of the investment program for 2010 with executive authorities

Executive authorities of the subjects of the Russian Federation approved the initial investment program for 2010 on 15.02.2010. The adjustment of the investment program for 2010 was conducted and approved by the following representatives of executive authorities:

D.V. Koptin - the Chairman of the Committee on Tariffs of St. Petersburg, on 29.09.2010

V.P. Serdyukov - the Governor of the Leningrad Region, on 06.10.2010

The Board of Directors of JSC "Lenenergo" approved the adjusted investment program for 2010 on 21.10.2010.

Top