Financial Results Overview

Financial Plans up to 2015

The key forecasted financial indicators of JSC "Lenenergo" in compliance with the Business plan of the Company 22 for 2011-2015 resulted in the following table.

| Indicator | Unit | Formula | 2011 | 2012 | 2013 | 2014 | 2015 | 2015/2011 |

|---|---|---|---|---|---|---|---|---|

| Equity | RUR mln | l. 490 (f.1) | 101,1% | |||||

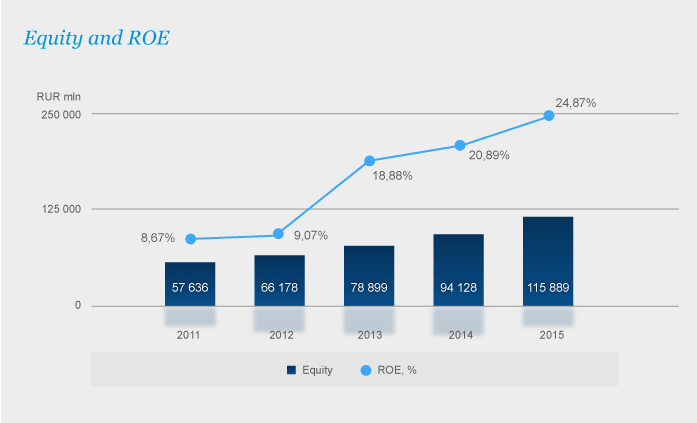

| ROE23 | % | 190 (f.2) / 490 on beg. (f.1) | 8,67% | 9,07% | 18,88% | 20,89% | 24,87% | 186,9% |

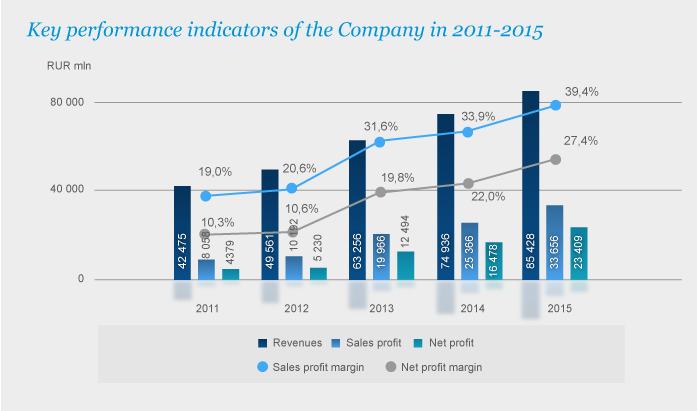

| Revenue from sales of goods, including: | RUR mln | l. 010 (f.2) | 42 475 | 49 561 | 63 256 | 74 936 | 85 428 | 101,1% |

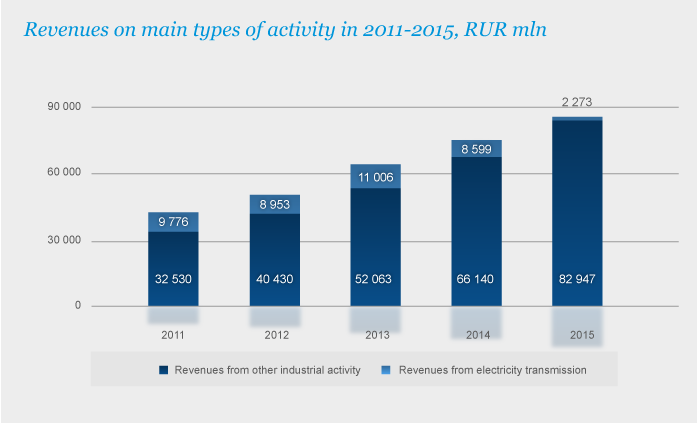

| - From electric power transmission | RUR mln | — | 32 530 | 40 430 | 52 063 | 66 140 | 82 947 | 155,0% |

| - From technological connection | RUR mln | — | 9 776 | 8 953 | 11 006 | 8 599 | 2 273 | -76,7% |

| - From other industrial activity | RUR mln | — | 169 | 178 | 188 | 198 | 209 | 23,3% |

| COGS | RUR mln | l. 020 (f.2) | 34 416 | 39 370 | 43 291 | 49 570 | 51 772 | 50,4% |

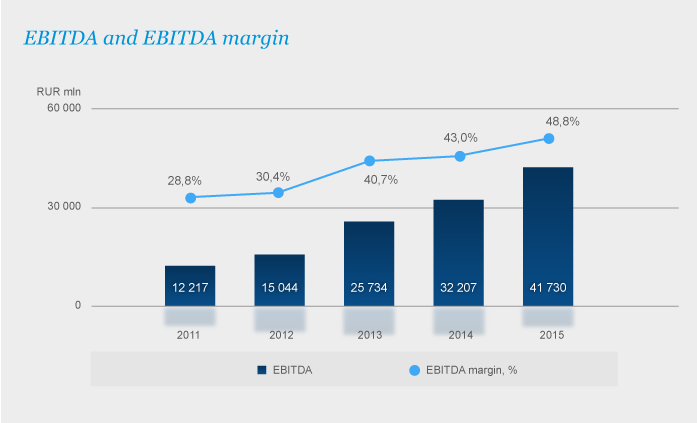

| EBITDA | RUR mln | l.190 f.2+l.150 f.2 +Deprecation+ l.070 f.2 | 12 217 | 15 044 | 25 734 | 32 207 | 41 730 | 241,6% |

| Gross profit | RUR mln | l. 029 (f.2) | 8 058 | 10 192 | 19 966 | 25 366 | 33 656 | 317,7% |

| Profit before taxation | RUR mln | l. 140 (f.2) | 5 953 | 7 021 | 16 105 | 21 094 | 29 766 | 400,1% |

| Net profit | RUR mln | l. 190 (f.2) | 4 379 | 5 230 | 12 494 | 16 478 | 23 409 | 434,6% |

| EBITDA margin | % | EBITDA/ Revenue | 28,8% | 30,4% | 40,7% | 43,0% | 48,8% | 69,8% |

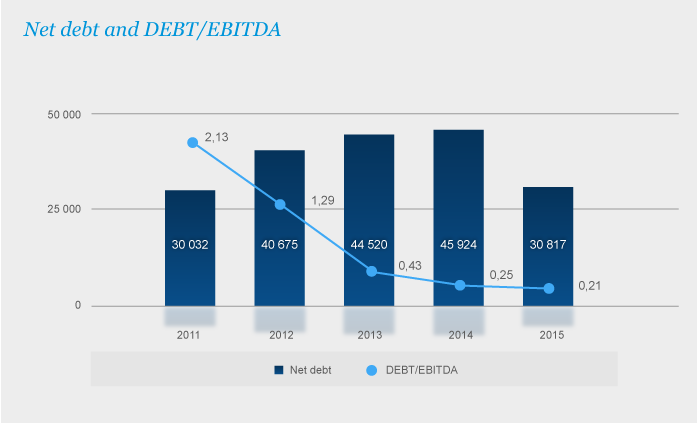

| DEBT/EBITDA | — | (610+620+630+660) (f.1) / EBITDA | 2,13 | 1,29 | 0,43 | 0,25 | 0,21 | -90,0% |

| Debt on the period end 24 | RUR mln | 510+610* | 31 750 | 41 320 | 44 902 | 46 332 | 31 332 | -1,3% |

| Net debt | RUR mln | 510+610-250-260 (f.1) | 30 032 | 40 675 | 44 520 | 45 924 | 30 817 | 2,6% |

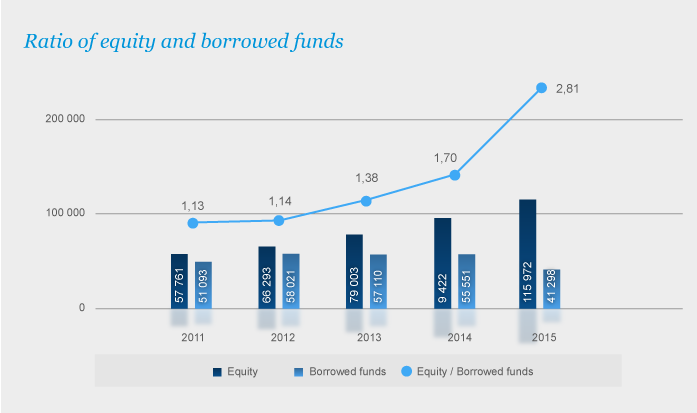

| Ratio of equity and borrowed funds | — | (490+640) / (700-490-640) (f.1) | 1,13 | 1,14 | 1,38 | 1,70 | 2,81 | 148,4% |

| Ratio of accounts receivable and accounts payable | — | Receivables/ Payables = (230+240) / (620+520) (f.1) | 0,63 | 0,72 | 0,87 | 1,18 | 1,08 | 72,3% |

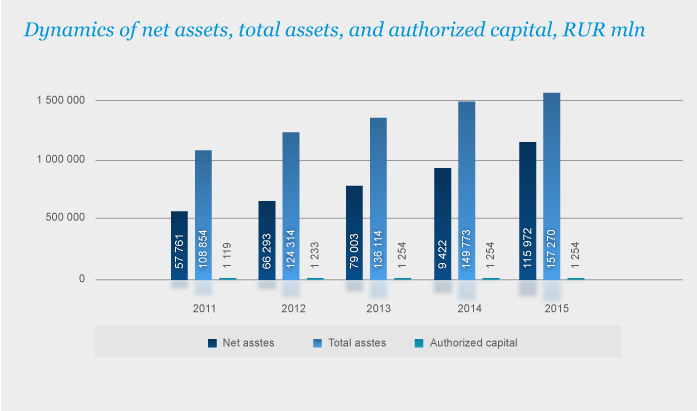

| Net assets | RUR mln | The order No.10-n of the Ministry of Finance of Russia | 57 761 | 66 293 | 79 003 | 94 222 | 115 972 | 100,8% |

| Book value of assets | RUR mln | l. 300 (f.1) | 44,5% | |||||

| Leverage | % | (510+610) / (510+610+490) (f.1) | 35,7% | 38,4% | 36,3% | 33,0% | 21,3% | -40,3% |

22 According to the Business plan of the Company for 2011, approved by the Board of Directors as of 30.12.2010, Minutes No.11

23 Calculation of ROE for 2011-2015 is performed according to the technique regulated by the Standard of business planning of the Company. For calculation of ROE the corrected indicator of net profit is used.

24 Note: the debt on the end of the period is calculated as liabilities on the sum of the main debt under credits and loans (i.e. the sum of lines 510 and 610 of balance sheet, except for liabilities on accrued, but not paid interest).

The transition of JSC "Lenenergo" to RAB-regulation becomes the basic catalyst of considerable improvement of the Company’s financial and economic condition and growth of value.

RAB-regulation will allow the Company to borrow long-term capital in the necessary volume for financing the scale investment program developed for complex renovation and modernization of network facilities.

For the first five years period of RAB-regulation (2011-2015), JSC "Lenenergo" plans to considerably improve the financial condition, which is testified to by the positive dynamics of the majority of key forecasted indicators of the Company’s performance.

Revenue growth in 2015 in comparison with 2011 is expected at a level of 101.1%, which essentially advances the increase rate of COGS (50.4%). The essential increase in revenues from electric power transmission for 2011-2015 is thus forecasted, at a simultaneous decrease in revenues from technological connection.

The revenues from technological connection are specified for 2011-2015 under condition of implementation of the strategy on liquidation of accumulated and overdue liabilities, and accomplishment of current obligations in the terms established by the legislation. For 2011-2015, the share of services on technological connection in revenue is supposed to decrease to 2.7 % in 2015.

This is associated with the fact that RAB-regulation allows passing from volatile incomes on technological connection to the more stable model at which the basic profit is formed at the expense of electric power transmission.

Growth of EBITDA for 5 years is forecasted at the level of +241.6% followed by growth of EBITDA margin to 48.8% in the end of the first period of regulation (in 2015) that, in general, is regarded positively. Thus, the share of net profit in the structure of EBITDA increases, and in the end of 2015 exceeds 50%.

A considerable increase in net profit (+434.6%) for 2011-2015 is caused by essential growth of the Company’s revenue from electricity transmission services. Within the five years, equity of the Company will also increase (+101.1%), and ROE will reach its maximum of 24.87% in 2015

In terms of the advancing growth rates of equity in relation to cumulative liabilities of the Company, the dynamics of the ratio of its equity and borrowed funds is also characterized by a growth tendency.

Until 2014, the part of borrowed funds is attracted by the Company for refinancing of credits and loans repaid in compliance with the terms of contracts. Starting from 2015, the gradual repayment of accumulated liabilities under credits and loans begins, and credits borrowed for financing of operational activity are repaid first.

Accordingly, the net debt of the Company increases from 2011 to 2014, and by the end of the regulated period it starts to decrease.

During the complete regulated period (2011-2015), DEBT/EBITDA does not exceed the level of 3.0, and it decreases within the five years, reaching the ratio of 0.21 in 2015. The low value of the indicator testifies that the generated cash flow will completely cover the Company’s current short-term liabilities. Besides the growth of EBITDA, the decrease in DEBT/EBITDA will be affected by accounts payable reduction on the advances received from subscribers on technological connection owing to execution by the Company of its obligations.

The growth of leverage until 2012 is associated with the considerable borrowing of extra funds and the advancing growth of the sum of liabilities in relation to the increase in equity. By the end of the five years' period of regulation, leverage reaches the recommended value (<30%).

Throughout 2011-2015, net assets remain within the limits of recommended legislative values, at a level considerably exceeding the size of authorized capital of the Company.

In general, following the results of the first period of RAB-regulation the financial condition of JSC "Lenenergo" will improve as compared to 31.12.2010.

Top