Corporate Governance and Securities of the Company

Authorized Capital. Structure of Share Capital

The Company’s Authorized capital is RUR 1,019,285,990.04 as of 31.12.2010, and is divided into 926,021,679.04 ordinary shares with a par value of RUR 1 each and 93,264,311 preferred shares with a par value of RUR 1 each.

| Brief History of the Company’s Issuing Activity | State Registration Number | Number of shares, pcs. |

|---|---|---|

| First issue: | 72-1p-191 | 2,951,852 |

| The shares were issued in connection with the privatization of the Company by virtue of Decree No.923 as of 15.08.1992 of the President of the Russian Federation. The issue was registered by the Financial Committee of St. Petersburg Mayor’s office on 01.02.1993. Par value: RUR 1,000 (before denomination). Minutes on the results of the issue were officially registered on 06.09.1999. Including: | ||

| Ordinary shares | 2,519,852 | |

| Preferred shares | 432,000 | |

| Additional issue (1): | 72-1-2367 | 894,411,156 |

| The issue was registered by the Economical and Financial Committee of St. Petersburg on 29.09.1995. Par value of each security of the issue: RUR 1,000 (before denomination). Minutes on the results of the issue were officially registered on 09.08.1999.

Including: | ||

| Ordinary registered shares | 763,515,156 | |

| A-type preferred shares | 130,896,000 | |

| Consolidation of issues | ||

| The issues were merged by the Decree of the Financial Committee No.03-1269/r as of 27.06.2003. Par value of each security of the issue: RUR 1.

The size of Charter capital decreased as a result of the redemption of shares according to the decision of the General Meeting of Shareholders on the reorganization, held on 08.04.2005 (Minutes on results of the redemption as of 01.08.2005): repayment of a part of ordinary shares by redemption from the shareholders quantity of securities is reduced by 74 180 864 pieces; repayment of a part of preferred shares by redemption from shareholders, quantity of securities is reduced by 38,063,689 pieces; Following the results of the redemption of shares the Charter capital structure corresponds to: | ||

| Ordinary registered shares | 1-01-00073-А | 691,854,144 |

| A-type preferred shares | 2-01-00073-А | 93,264,311 |

| Additional issue (2)* | 1-01-00073-А-001D | 234,167,535.04 |

| The issue was registered by the Federal Service for Financial Markets of the Russian Federation on 25.10.2007. Par value of each security of the issue: RUR 1.

Minutes on the results of the issue were officially registered on 12.12.2008. | ||

| Cancellation of issues | ||

| Notification of the FSFM of Russia as of 01.04.2009 No.09-EK-03/6679 performed cancellation of the individual number (code) of additional issue of securities. Par value of each security of the issue: RUR 1.

At the current moment there is a uniform registration number (No. - 1-01-0073-А) on a share issue, on the expiration of 3 months from the moment of the state registration of Minutes on results of additional issue of ordinary registered shares of JSC "Lenenergo" cancellation of the individual number of additional issue - 001D (GRN – 1-01-0073-А-001D) was performed. | ||

* - The additional issue of JSC "Lenenergo" was aimed at creation of a unified grid company in St. Petersburg with a higher technological and economic reliability on the basis of uninterrupted and interconnected network equipment.

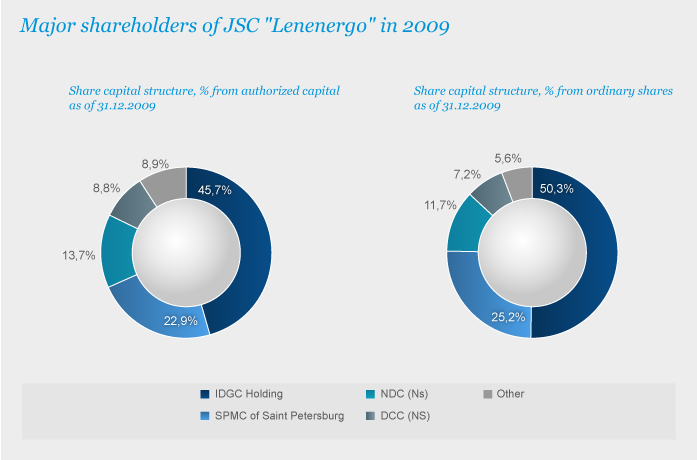

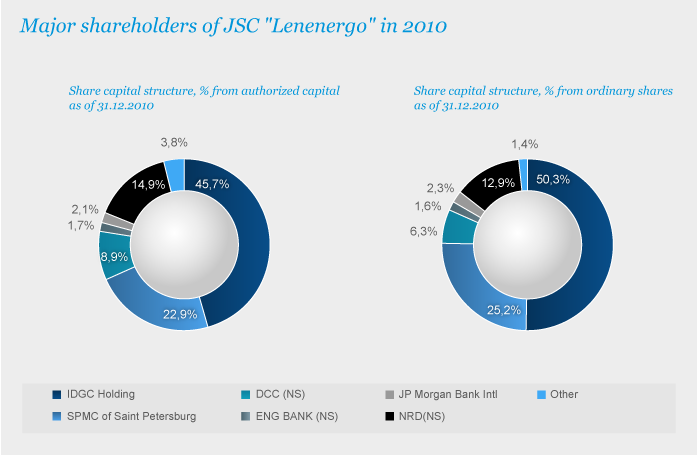

Share capital structure

| Information on Shareholders as of 31.12.2010 | Number of Shareholders | % from Authorized capital |

|---|---|---|

| Nominal shareholders | 13 | 74.26 |

| Corporate shareholders | 38 | 23.03 |

| Individual shareholders | 6,476 | 2.69 |

| Pledge holders | 1 | 0 |

| Shares in joint share possession | 45 | 0.02 |

| TOTAL, number of persons in the register of shareholders | 6,174 | 100.00 |

Structure of share capital as of 31.12.2010, over 1%:

| Name of Shareholder | Share from Authorized capital as of 31.12.2010 | Portion of ordinary shares as of 31.12.2010 |

|---|---|---|

| IDGC Holding | 45.7% | 50.3% |

| Federal City of St. Petersburg, represented by the State Property Management Committee (SPMC) | 22.9% | 25.2% |

| NRD (Nominal Shareholder) | 14.9% | 12.9% |

| DCC (Nominal Shareholder) | 8.9% | 6.3% |

| JP Morgan Bank International (Nominal Shareholder) | 2.1% | 2.3% |

| ENG BANK (Eurasia) (Nominal Shareholder) | 1.7% | 1.6% |

| Other | 3.8% | 1.4% |

| TOTAL | 100% | 100% |